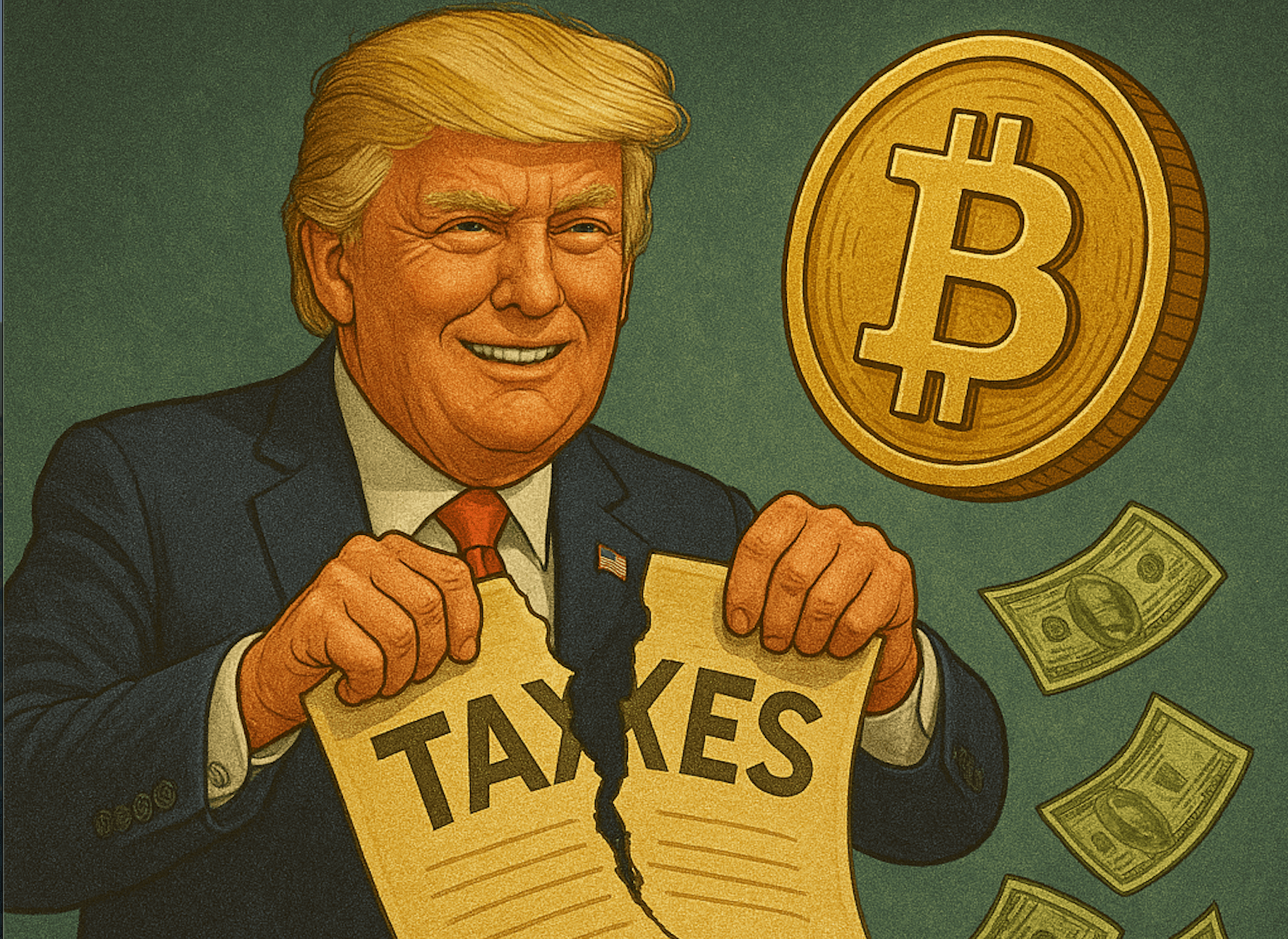

The chances that Trump will reduce (or completely remove) taxes on crypto

Trump might try to reduce or completely remove crypto taxes for projects based in the U.S., such as XRP, Solana, and Cardano. Although the investors would be happy with such a scenario, it is still not a reality.

1. What Is Being Proposed?

- 0% Capital Gains Tax on U.S.-Based Crypto?

Eric Trump, the acting executive vice president of the Trump Organization, has outlined a plan to completely cut off capital gains tax with the aim of crypto-assets created from domestic projects such as XRP, Cardano (ADA), Solana (SOL), and Algorand (ALGO) (Crypto Tax Calculator, CoinLedger).

- There Is No Official Bill

This notion is still only a concept. At present, no such tax reform proposal in Congress introduces a bill, and it is inferring that it may be for short- or long-term gains and defining what "U.S.-based crypto" would mean (CoinLedger).

2. Do Real Chances of It Happening Exist?

- Speculative but Likely Appealing

According to tax specialists like Wesley Barton, "It really looks like a move in one of the easiest ways for Trump to charm retail investors and crypto-native voters if he were to cut or outright remove capital gains tax on crypto." Politically, it would make sense, but not without bumps on the road (Crypto Tax Calculator).

- The Market Mood Reflects The Optimism

At platforms such as Polymarket, the probability of Trump cutting long-term capital gains taxes has risen to about 57%, indicating the market is cautiously optimistic - but again, this is only speculation and not firm policy (TheStreet).

3. Why It Is Not A Done Deal Yet

- Congress Holds The Power

Only Congress has the power to pass this type of bills into law even if crypto-friendly tax reform were to be supported by Trump. Up to this point, no formal bills have been introduced or had any significant progress.

- Federal Tax Laws Are Still Applicable

Until the new law is passed, all the existing tax regulations will still apply. Accordingly, earnings from cryptocurrencies will be taxed under the existing tax rates, that is, short-term (10–37%) and long-term (0–20%) (CoinLedger, Koinly).

4. Context From the Administration’s Broader Crypto Agenda

- Policy Signals: It’s Crypto-Friendly

Politically, the Trump administration has managed to turn the tables in favor of the crypto market by implementing numerous pro-crypto measures - among them executive orders promoting blockchain innovation, appointing a “crypto czar,” and the launch of a strategic Bitcoin reserve and “digital asset stockpile” (Pillsbury Law, Wikipedia).

Such initiatives lay a positive foundation for policy suggestions like tax reduction, even if they have not yet been turned into laws.

5. Verdict: Will Crypto Taxes Be Slashed?

- Possible—but Far From Certain

The objection to the abolition or reduction of capital gains tax on U.S.-based cryptocurrencies by way of a real proposal and its power to attract immediate attention is only the beginning of the story. The journey to being law is long and full of obstacles. It will require legislative approval, very specific definitions, and careful consideration with other tax policies.

- Market Excitement Ahead of Confirmation

The crypto community can only anticipate the coming days when this excitement will gradually fade as the buzz becomes reality or there will be disappointment. In the meantime, however, it is worth reiterating the existing crypto tax rules to which the investors must stick.

Summary

The speculation is mounting and so is the political signaling that Trump administration might be taking crypto-friendly steps, including tax reductions. Without a bill, however, these are nothing more than mere aspirations. The real fight is the next one: from proposal to law.

The Trump team has suggested the possibility of significantly reducing crypto taxes, maybe even cutting to zero the capital gains tax for some projects in the U.S. It is obvious that the administration is in favor of cryptocurrencies; however, the proposal is still political conjecture with no backing by law. At present, those holding cryptocurrencies need to continue paying the usual taxes. However, if Trump manages to rally sufficient support, a tax relief might still be coming.

About the Author

Sarah Byrne

Sarah Byrne writes about fintech and iGaming, with a focus on crypto pay and online games. She gives tips on Bitcoin games, quick cash outs, and safe web play. She helps gamers find safe and new fun at casinos.

Trump might try to reduce or completely remove crypto taxes for projects based in the U.S., such as XRP, Solana, and Cardano. Although the investors would be happy with such a scenario, it is still not a reality.

⚠️ Responsible Gambling Reminder

While bonuses can boost your play, always gamble responsibly. Set limits, take breaks, and remember that bonuses aren't guaranteed wins. For support, visit www.gambleaware.org.